My 3 interesting things for you this month…

1. Predictions for 2025: What Lies Ahead?

2025 promises to be a huge year for finance! And as things continue to change quicker than ever, I thought I’d share some of my key predictions for 2025 to help you stay ahead in the upcoming year.

Here’s what I think is coming – and how we can all prepare.

1. AI Will Drive Strategy, Not Just Automation

AI has already transformed routine tasks like invoice processing and reconciliation. In 2025 we’ll see it move from simply automating processes, to actively shaping business strategies.

Predictive analytics will help finance teams forecast trends more accurately, letting us make data-driven decisions in real time.

What can you do? If you’re not using AI on an almost daily basis, you should be. Make 2025 the year it becomes your go-to tool.

2. Real-Time Insights Will Rule

To stay agile as things change quicker than ever, businesses will rely more heavily on real-time insights.

Static monthly reports just aren’t cutting it anymore. Instead, finance teams should be prepared to adopt cloud-based solutions, streamline data collection, and enable live dashboards that decision-makers can access easily.

What can you do? Build a working group to think about what real-time reporting could mean for your company. What challenges need to be overcome? Where will we start? How will we get the resources? How will we take people with us?

3. From Back Office to a Strategic Force

In 2025, finance will break free of its reputation as a back-office function! Instead, finance professionals will act as strategic partners who advise on key decisions that drive growth and efficiency.

This means stepping out of the spreadsheets and engaging more directly with other departments.

Hasn’t this been true for the last 10 years I hear you cry?! Why is 2025 any different?

The key change (as is often the case!!) is AI. Using AI lets teams do more value-add work. If they don’t, the business will start to plug the gaps with AI themselves…

What can you do? Work on your communication and influencing skills. Learn to tell compelling stories with financial data to guide cross-functional teams.

4. ESG Reporting Becomes Non-Negotiable

Environmental, social, and governance (ESG) metrics will no longer be a “nice-to-have” and instead be an essential part of corporate reporting. Stakeholders are demanding transparency on how companies impact the planet and society, and finance teams will need to integrate ESG metrics into traditional reporting and tie them to financial performance.

What can you do? Familiarise yourself with ESG frameworks and how to track ESG performance.

5. Upskilling and Reskilling is a Non-Negotiable

As new technologies emerge, finance teams will need to upskill in areas like AI, automation, transformation, advanced analytics and business strategy, while also developing soft skills like leadership and adaptability.

What can you do? Create a personal development plan for 2025, focused on the next set of skills.

Get in touch if you need help with any of the above

2. Big Ideas = Big Bucks: Impact of Power Laws on Finance

Over the last few months, I’ve been thinking a lot about Power Laws, after a friend shared that their CEO talks about them a lot.

In finance (and in many other areas of life!) not all ideas or decisions carry equal weight. The concept of power laws shows that focusing on a few high-impact ideas can be more valuable than spreading energy across many smaller, average ones.

Understanding and applying this principle can transform our impact, our team’s impact, and even our organisation’s impact.

So, what are power laws?

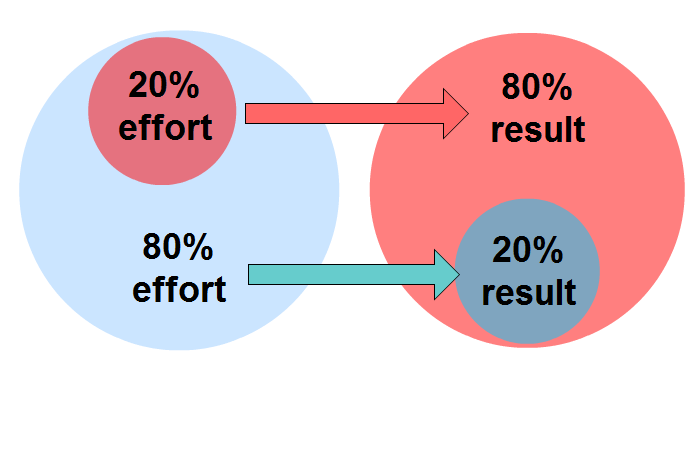

Power laws describe situations where outputs are disproportionately influenced by a few key inputs. In other words, a small percentage of efforts lead to a majority of results.

This principle is seen in wealth distribution (the top 1% hold most of the wealth), venture capital (one startup in a portfolio often outshines the rest), and even nature (a few species dominate ecosystems). This is very similar to the 80/20 on 80/20 I discussed last December!

Image Credit: Next Generation Automation

In finance, the same rule applies: one extraordinary idea or decision can deliver returns that dwarf the impact of 20 smaller ones. Let’s look at some examples:

1. Strategic Investments

Instead of fully funding a few big projects, using a portfolio approach to find initiatives with transformative potential will often yield far better overall returns – giving you more chance of hitting the jackpot.

Or, once you find a really powerful idea, invest into it. For example, investing in AI-driven analytics could revolutionise reporting processes, while incremental upgrades to existing systems will just give you more of the same.

2. Client Relationships

Not all clients or stakeholders contribute equally to a company’s growth. The top 20% of clients typically generate 80% of the revenue, and recognising and nurturing these relationships can amplify business impact.

The same is true of people we partner with – ask yourself who has the highest business impact, and how can we partner them to more success?

3. Decision-Making

Many financial decisions have a negligible impact on the bottom line. Occasionally, however, a single strategic pivot, like launching into a new market or embracing a cutting-edge technology, can create exponential growth.

How can we work with the business to help identify these? What questions can we ask to help our partners move towards them? What frameworks help to make progress against them?

How can we apply this practically?

- Think through the areas you support – how do we enable some big ideas to be more successful than others?

- How can we spend our time so more of it is allocated to big opportunities, things that will make a real difference?

- Figure out the drivers that have the highest impact on your organisation, and how they can be impacted. Focus your time, and ideally your business partners, there.

3. Ideas on how to use AI in finance from Microsoft’s CFO

At a recent summit, Amy Hood, Microsoft’s CFO, highlighted how AI can revolutionise finance teams and the operations they support, driving efficiency and strategic decision-making.

You can read it for yourself here, but here are key insights and actionable takeaways:

1. AI Transforms Finance Processes

AI-enabled automation isn’t just about saving time – it creates smarter, more adaptive systems. For example:

- Smart Cash Application: Automatically matching payments to invoices on a huge scale, saving 1,600 hours per month.

- Journal Entry Automation: Eliminate inefficiencies, saving 18,000 hours annually

- Anomaly Detection: improving fraud prevention and compliance with AI flagging unusual transactions.

How you can use this: Identify repetitive tasks that can be automated using AI tools like Microsoft Copilot or ChatGPT. Look out for my course launching in January with more on this!

2. Accelerated Decision-Making Through AI Insights

AI enhances decision-making by delivering real-time, actionable insights:

- Variance Analysis: Detects and flags deviations over a set threshold for immediate review.

- Strategic Forecasting: Model scenarios and their relative impact to inform resource allocation.

- Earnings Summaries: Reduces prep time by 50%, enabling faster reactions to investor feedback.

How you can use this: Use AI-driven analytics to reduce manual effort and gain sharper insights into financial performance.

3. Practical AI Integration in Finance

Starting small and scaling AI projects strategically is key to unlocking value.

Examples from Microsoft include:

- Tax Efficiency: Automating the tax review processes, cutting review time by 60%.

- Expense Reporting: Streamline reporting, reducing manual volume by 70%.

- Quote-to-Cash Processes: Improves quote creation time by 50%, accelerating revenue cycles.

How you can use this: Focus on areas with clear bottlenecks or inefficiencies, like tax reviews or procurement, to quickly realise AI’s benefits.

4. Build a Culture Ready for AI

AI’s success relies on a strong organisational culture:

- Celebrate quick wins and reward early adopters of AI-driven solutions.

- Foster collaboration across teams and align AI efforts with broader business goals.

How you can use this: Involve cross-functional teams in AI projects and recognise contributions to drive adoption.

Want more insights?

Sign up to my interesting things newsletter here to get tips like this and more.