My 3 interesting things for you this month…

1. A framework for finance leadership

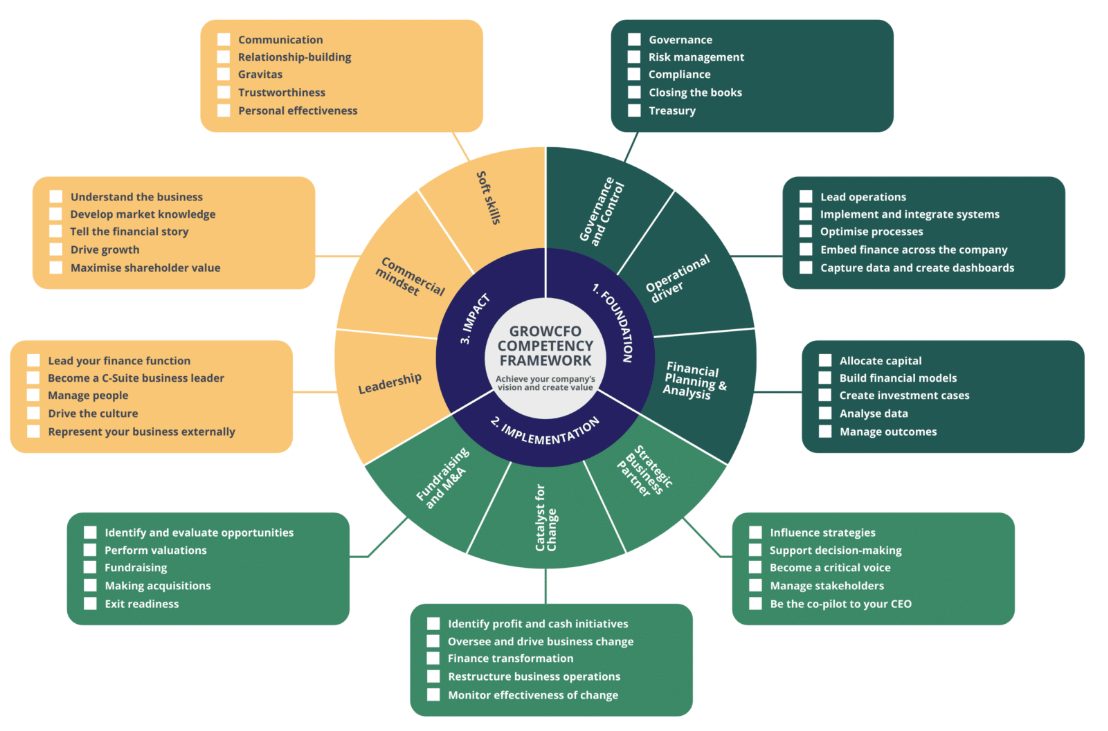

I love a good framework – as many of you who’ve worked with me know! Today I want to share with you a competency framework that the team at GrowCFO use for helping people think through their career development towards being a finance leader (I am a coach and facilitator for GrowCFO). There’s a lot to take in, so you can see a larger version of this diagram on their site here.

What I like about this is how it shows the breadth of areas a finance leader needs to be competent at. The list is not exhaustive, but it is a great starting point (fundraising and M&A may not apply if you’re in a larger corporate organisation). But you could exchange this one for operating effectively within a large organisation.

If you would like to think through more of a development plan around some of the specific areas, do get in touch, or take a look at some of the options GrowCFO have.

2. Thinking differently about compensation

Lots of us are either responsible for setting compensation packages for others as managers, or for negotiating for ourselves as employees.

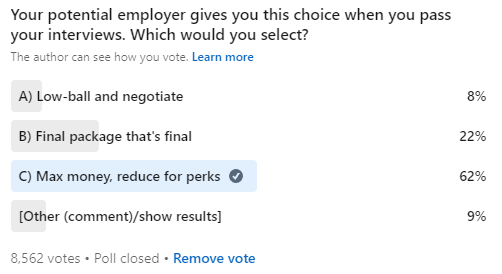

I came across (a very rare!) interesting poll on LinkedIn by the Chief Decision Scientist at Google, Cassie Kozyrkov. Here are the results on what people would like to get when they receive a job offer.

(Interestingly, I initially voted and screenshotted after 1,600 votes. The results split remained exactly the same after the poll closed with 5x more votes.)

The takeaway for me: employees today care about much more than just total salary. They want to think about options for their time, flexibility, location, and benefits. I really like this option of offer max salary and then give choices on how you can get customisation of work.

We will need to be more creative and flexible in how we think about our employee benefits in future to support a more diverse workforce with a range of needs. This will help us unlock the maximum potential of not just the finance workforce, but any workforce.

On this topic, I met a coach this week who specialises in helping organisations to support parents returning from maternity/paternity leave back into the workforce. With all the ideas, options and benefits of doing so. Many things even I hadn’t considered! Let me know if you’d like me to put you in touch with her by emailing me.

3. Leading and lagging indicators

One of the most challenging concepts to get across to non-finance colleagues in finance and goal setting, is that of leading and lagging indicators.

Leading indicators predict the change of larger-scale, slower-moving metrics (lagging indicators). Leading indicators help organisations focus their day-to-day actions on their most important metrics, instead of just focusing on final results, which can be hard to impact directly. Lagging indicator outcomes could be revenue, profit, cash, customers, stock, or anything else you are trying to achieve. Leading indicators are what will predict their success.

As part of my work with OKRs (Objectives and Key Results), I spend a lot of time trying to explain leading and lagging indicators. It’s hard. So I was really excited when my AuxinOKR colleagues shared this graphic by Tim Herbig that sets them out more clearly than I’ve seen before.

The framework requires most of us to figure out what the metrics are in each of the sections. Once we do it’s a really clear way to think about this concept.

The full post (here) goes into quite a bit of depth on a specific metric, but this layout of input / output / outcome / impact when it comes to our KPIs is really valuable.

If you’d like some help thinking this through for your organisation or business unit, let me know.