My 3 interesting things for you this month…

1. Everything you need to build a great career

A lot of my coaching work involves helping people think through careers: what job to do next, which skills to develop, how to brand their CV and LinkedIn effectively, what getting promoted entails, how to interview like a top 5% performer and then negotiate your true worth in the market.

To make the most of our coaching time, it’s actually more effective if people understand the industry context, key frameworks and career methodologies before we start. So, in conjunction with the ICAEW careers team, I put together a series of 6 videos that cover all the main foundations of building a great career.

Some of you might be worried for me! “Oli, why would anyone come and work with you if you give away all the content for free?!”.

Because for most folks, it’s still pretty challenging to put the frameworks into practice – but we can focus our time together on removing blocks and challenges to success.

So check them out, the 6 sessions are:

Future of the Finance Professional: Are you ready?

Figure out what you’re famous for (finding your professional purpose)

How to build a great CV and use the full power of LinkedIn

How to wow in interviews and negotiate your worth

How to Manage Your Career Like a Pro

2. Delegation’s what you need, if you want to be a great manager

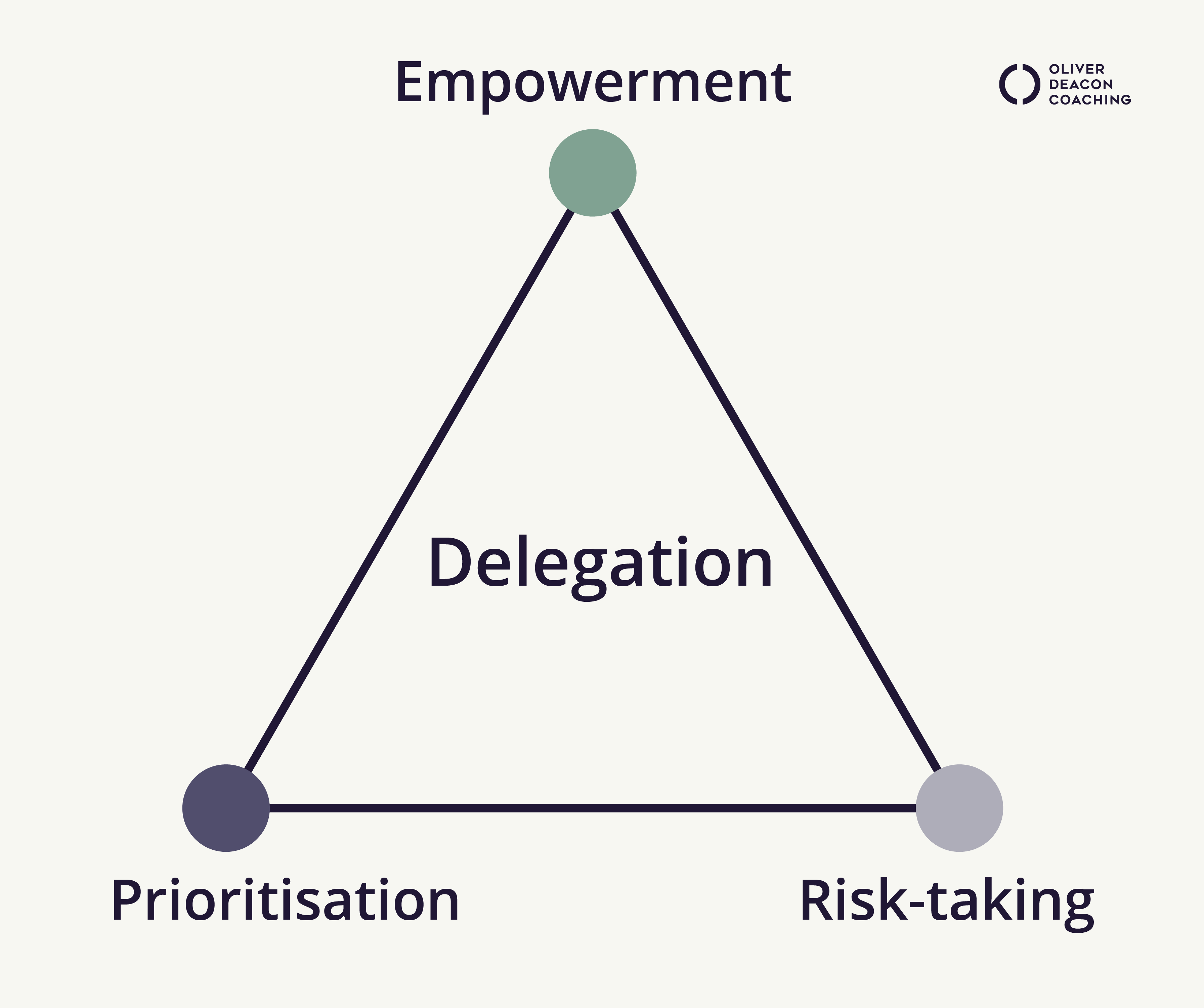

Getting to a leadership role in finance requires a different approach. It’s no longer possible to control or have direct oversight of every single thing that’s going on. Effective delegation is the key to scaling our work.

The magic here is to use three different techniques to form an effective approach to delegation.

1. An empowerment model

Shift the focus from the ‘how’ to the outcomes, and what you want from those outcomes.

2. A prioritisation framework

Seems obvious? But you need one that actually works!

3. A strategic approach to risk-taking

Very specifically, how do you decide what to let go of, and where are you willing to let quality dip to enable others to grow?

The combination of these three things rapidly results in a more impactful leadership approach. You can read more detail about them here, and I would love for you to come to have a chat with me about how you can apply this.

3. Upgrading your finance processes

Do you know how to map and redesign a process – specifically a finance one? Does someone in your team? Nope? That’s standard.

Across my clients, almost no-one has experience of professionally fixing processes. And yet more than ever, this can have a greater impact on what we do than anything else.

On our Finance Team Transformation course, the single answer that 95% of attendees give as to why they can’t spend more time on high value finance activities is time. Fixing long terrible processes is the most obvious way to get more time.

The solution is to upskill our teams in basic process improvement techniques. They aren’t hard, but almost all of us make up from first principles what years of management ‘science’ has shown to work best.

We’ve had a go at trying to solve this issue in a simple way: teaching finance people the core tools that a management consultant or project manager would use to improve a process.

We launch the course this summer. You can check it out and book your place here.