Measuring Return on Investment (ROI) is a critical part of being an awesome finance person! It’s used to evaluate the efficiency or profitability of an investment, or compare the efficiency of different investments.

The problem with how it’s done lies in the old school way we’re taught about it. You buy a piece of machinery for £X and it made Y amount of £Z widgets for four years, we know how to measure that. But the truth is, that’s not how the finance world works any more. Instead, we invest in people, in marketing, and in all kinds of non-tangible functions and processes. The hard part is, these things don’t always add clearly defined value, at least in the traditional sense. With this in mind, the way that we measure ROI is changing.

Traditionally, we used methods such as Discounting Cash Flow (DCF), Net Present Value (NPV) and Internal Rates of Return (IRR). All very useful. However, the world is moving on, and lots of big tech organisations are thinking differently about two key things:

1) “How do we effectively measure ROI?”

2) “How do we ensure we’re maximising our ROI?”

How big tech companies are measuring ROI today

One of the main ways that big tech companies are looking at ROI is through Customer Lifetime Value (CLV). This looks at the whole lifetime of a customer to help you think about how (and whether or not) you initially invest in that customer.

This isn’t a new concept by any means, but the amount of data we can capture is new. In today’s digital world, we capture more data than ever before. We can see how long customers spend on our websites before making a decision, how long they stay on as a customer, how often they purchase our products, and how much they spend in an average purchase (and much, much, much more). And this data allows us to make much better, more informed business decisions.

For example, when you buy a new phone contract, phone companies know they lose money on the first two-or-so years of it. This is because their data shows that you will probably renew a certain number of times before changing providers. So they know they’ll make their money back on subsequent future contracts.

While many organisations haven’t started doing this yet… It will be a major part of the future finance landscape!

How are companies maximising ROI?

Traditionally, finance teams spent weeks and months researching, deliberating, and weighing up the pros and cons of an investment opportunity before deciding. But things change rapidly in today’s environment. New technologies launch constantly, updates are ready overnight, and customer’s demands quickly change. We must therefore make faster decisions on what to invest in, and what to leave. But traditional finance cycles aren’t set up to support this.

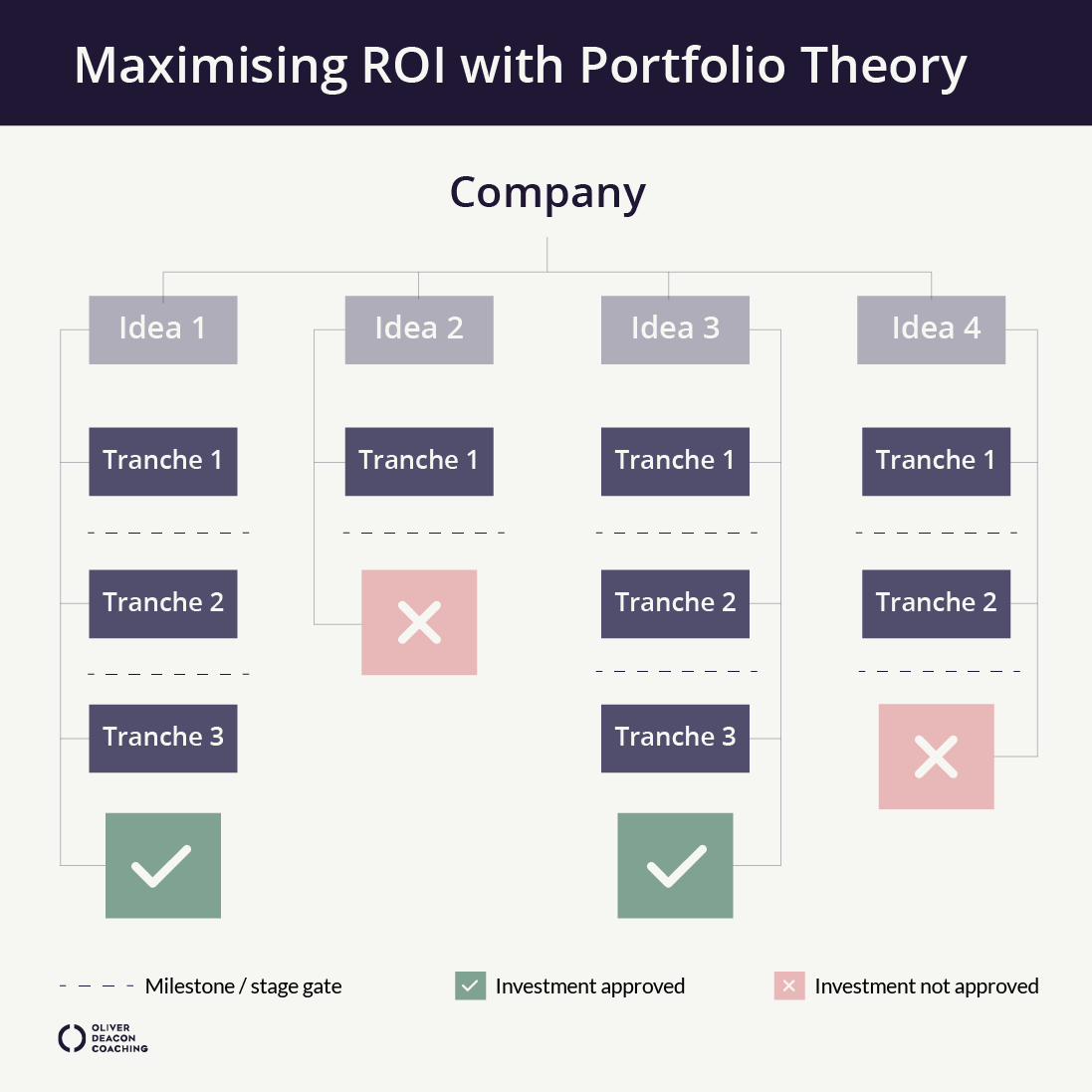

Instead, large organisations are turning to a new process to maximise their ROI. This process uses ‘Portfolio Theory’, also known as Modern Portfolio Theory (MPT).

Portfolio Theory

The idea behind portfolio theory within an innovation setting is this: At the start of the year, the company will take a ‘pot’ of money and set it aside. Then, throughout the year, departments come and ‘bid’ for money from the pot. If their bid is strong enough, and provides enough estimated ROI, then it’s accepted and the money is allocated. However, this money is only released in instalments (tranches), and the department needs to meet certain milestones to receive further funding.

Not only does this add an element of risk-mitigation around investments, but it also takes the element of ‘policing’ away from the finance department, which is great!

Previously people came up to the finance department and asked them for money, and they either said ‘Yes’ or ‘No’, and that was it. This made people think of finance as the ‘money police’. However, the allocation of money is almost self-governed by following the Portfolio Theory. Money will be provided if an investment is predicted to bring significant returns. If it fails to meet milestones, they won’t receive the next round of funding. Which means it’s a great way for organisations to invest internally in new ideas and technology, and to try new things, without too much risk.

Interested in learning more?

In my experience, many companies miss the picture when it comes to measuring ROI in the modern finance function. That’s why I’m running a course on how to measure ROI effectively. This course will equip you with powerful techniques to partner with commercial colleagues, enabling you to get to the core of commercial ROI, and influence business outcomes.

If there is a need for ‘Commercial Acumen’ in your role, this is the course for you!

I’ve just wrapped up on the latest running of this course, and a number of attendees gave some amazing feedback. So if you’d like to book onto the next course, click here for more information. Or get in touch with me if you’d like to learn a little more about anything discussed in this article.