My 3 interesting things for you this month…

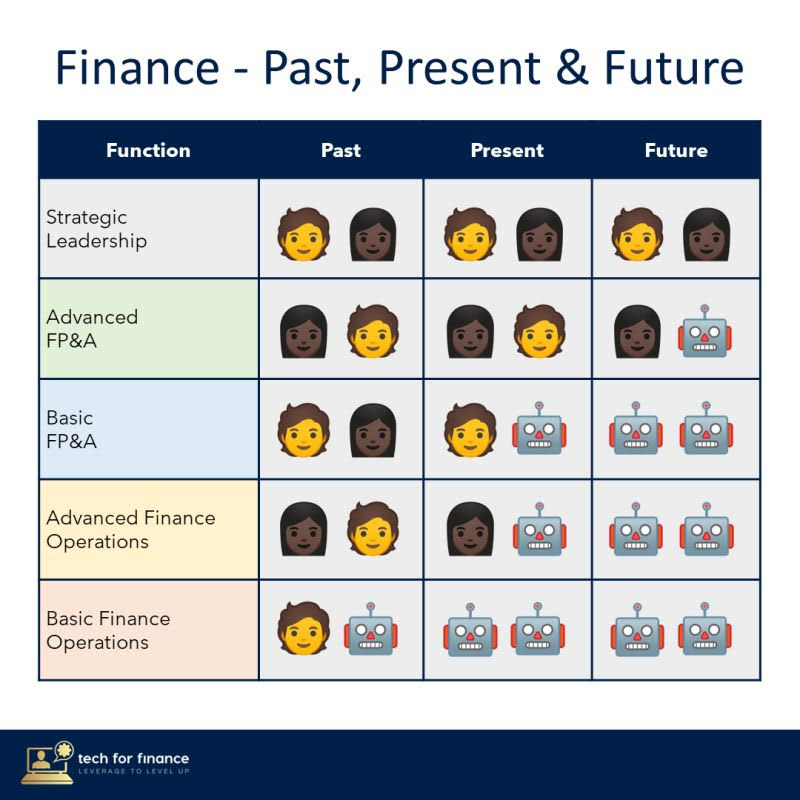

1.The evolution of finance’s role

I came across this great graphic this month from Adam Shilton, who talks a lot about finance and tech. I love the simplicity of how he demonstrates where we spend our time now and where we will in the future.

As you think about you and your team’s goals for 2023, reflect on how you are going to make progress from present to future.

A tip from me: if you don’t currently have a finance transformation person within your team (even if it is a part of their role), how will you change that next year?

More specifically, if you have 30+ people in your finance organisation, at least 1 should be dedicated full time to transformation projects.

You will see 3x-5x impact on your pace of change from that investment of resource!

Does it sound more appealing now?

2. Reflecting on 2022

How was 2022 for you and your teams? Weird? Busy? Challenging? Productive?

However it went for you, now is a great time to reflect on what went well, and what you might like to think about differently next year.

Encourage your team to do this exercise as well. Some key questions:

- What went well for us this year?

- What are we proud of?

- What could’ve gone better and why?

- What would we like to do better next year?

- What will be our biggest challenges in 2023?

- What would make 2023 a great year for the team?

- What do we need to change to achieve that?

A great team exercise to finish the year before you head out to your Christmas lunch!

3. Are you wasting your time with budgeting?

Budgeting is a necessary evil of finance. Heresy? Perhaps. But how much value add does it bring to organisations? I would argue not much.

It’s December year-end, the time of year when organisations are making the last few tweaks to their new year budgets…

Many started the work in the summer…

Many will still be making tweaks well into the new year…

But does all this effort and time make a difference?

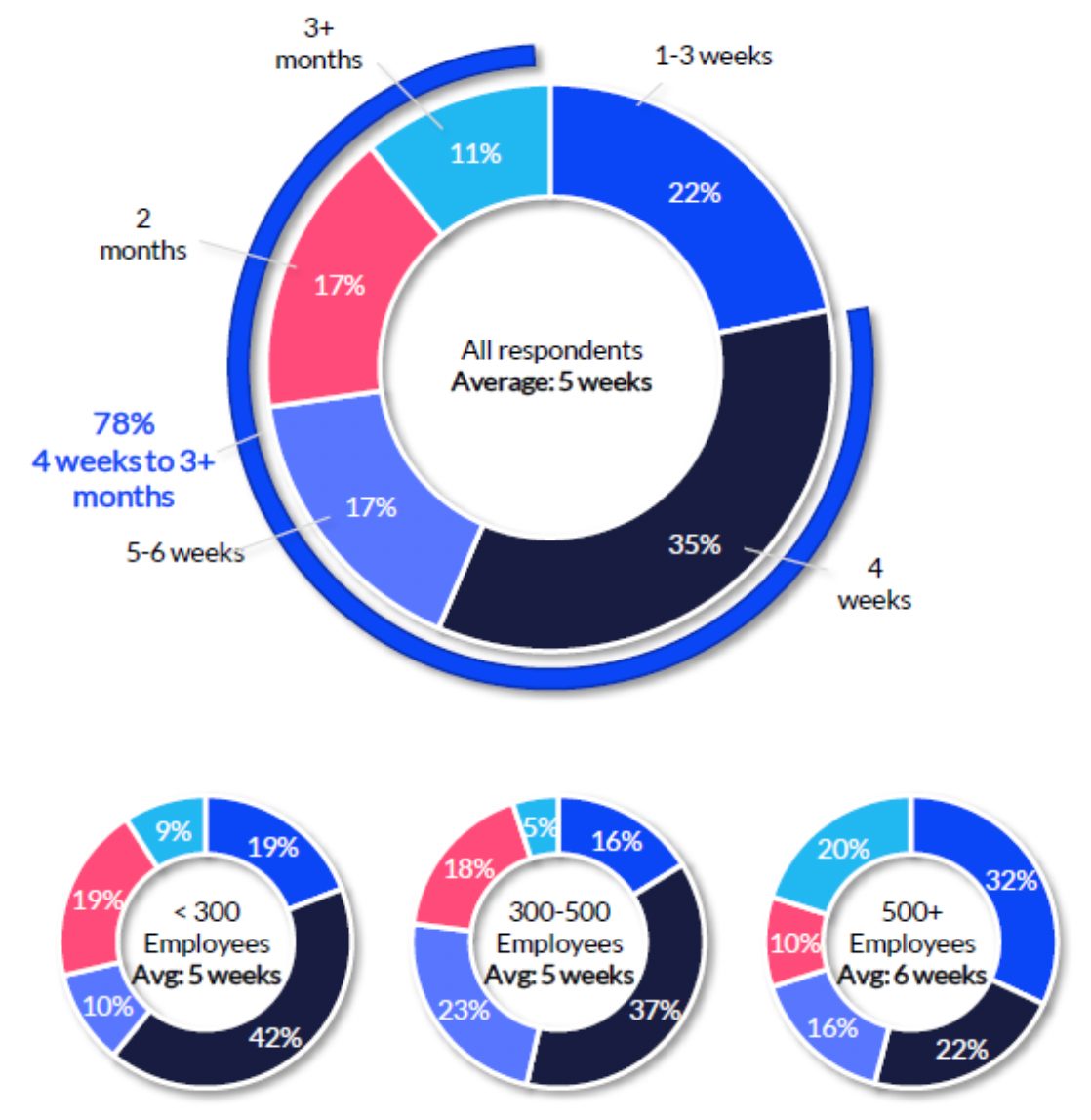

Data Rails released a survey earlier this year showing that, on average, finance leaders say they spend 5 weeks/year budgeting. I’m not sure many of my clients would agree with this! Most tell me 3-5 months.

So if finance leaders think it’s 5-6 weeks, and in reality, it’s double that. Are we adding value to the business? I would argue no.

So what to do about it?

As finance leaders, the more time we can spend on actuals, trends, external factors and business drivers – and the more we can limit budget focus – the more impactful our finance teams will be. As long as the budget is a good enough financial control, and you have set targets for bonuses appropriately, you can reduce the time spent on this.

If you have just finished, reflect on what you could do next year to cut the time. Everyone will thank you for it 🙂

Want finance tips sent straight to your inbox?

You can sign up to my monthly Interesting Things newsletter here.