My 3 interesting things for you this month…

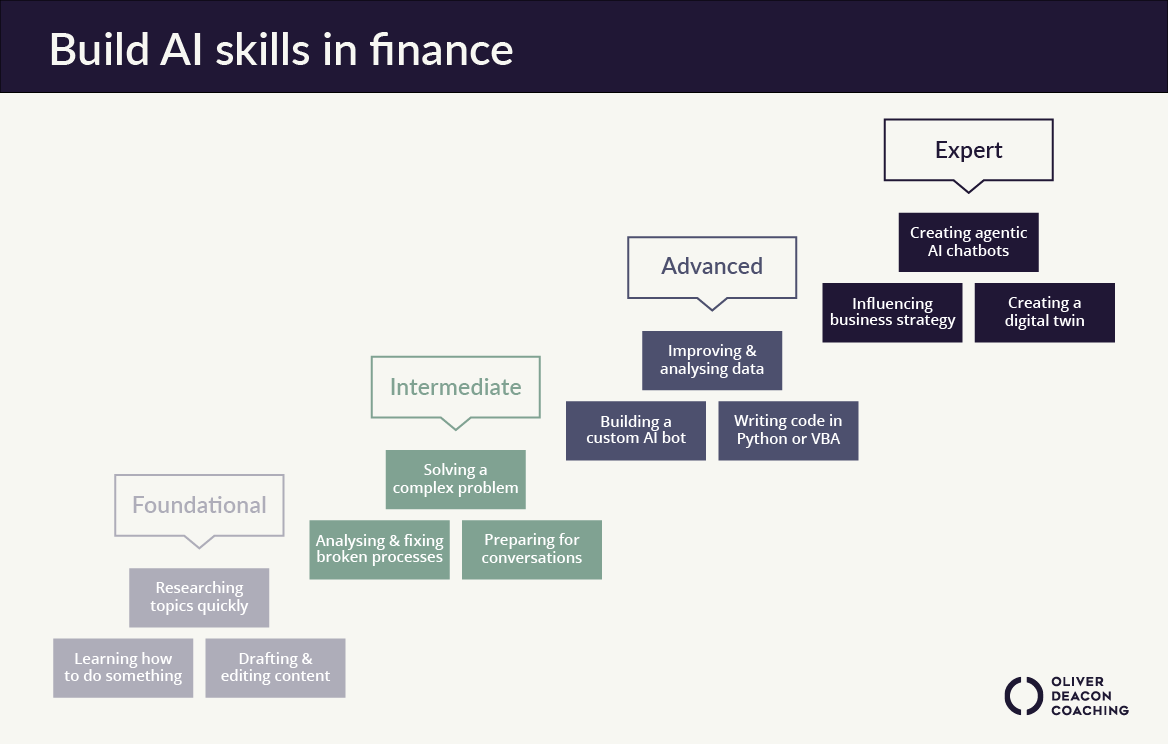

1. Building AI Skills in Finance: Where Are You on the Staircase?

We’re way past theory now. AI is already reshaping the finance function and over the next 12 months, we’ll see a clear divide between teams who scale with AI and those who get left behind.

So how do we stay on the right side of that divide? It starts by thinking about skill levels, not just tools. Who in your team is experimenting, who’s applying AI every day and who hasn’t taken the first step yet?

Here are the goals you should be trying to reach by year-end:

- 80 – 90% of finance teams should be using foundational AI skills most days of the week.

- 50% should be comfortable with intermediate-level tasks at least weekly.

- 10 – 15% should be AI champions, experimenting with advanced tools and tackling the high-impact problems.

For leaders, this means looking ahead. Understanding what’s coming at expert level, and beginning to reshape your operating model around it.

The staircase here shows how these skills build. Let’s break down a few of the steps to show what this looks like in practice, and where it’s heading.

Foundational: Researching Topics Quickly

If you’re still Googling like it’s 2019, you’re missing the point. AI tools can now synthesise and explain complex content in seconds. Think of tools like ChatGPT as a smart research analyst that never sleeps, handling everything from ESG regulations to the impact of FX hedging on net income.

But here’s the important thing: it’s about asking better questions, faster.

Instead of vague prompts, try something

“Act as a tax expert. Summarise the 5 key changes in IFRS 17 I need to be aware of.”

Intermediate: Fixing Broken Processes

This is where the gains start to get real. Think about the worst process you run – the one with the messy spreadsheet handoffs and the “just email it again” step.

AI can now help identify and rebuild these processes. Even free ChatGPT can help document process maps, suggest better workflows and even draft messages to get buy-in from stakeholders.

It’s time to stop tolerating broken processes and start fixing them. That’s what intermediate looks like.

Advanced: Data Analysis That Drives Action

At this level, it’s not just about dashboards. It’s about getting answers to questions you didn’t even know how to ask.

With the right security settings and tools, feed in messy data sets and AI can help clean them, find trends and recommend what to do next. It turns variance analysis into strategy, identifies forecast errors and suggests root causes and more.

If you’ve ever wished for an analyst who understands Excel, PowerBI and your commercial reality, AI is your answer.

And your AI champions? They’re the ones already playing in this space.

Expert: Creating a Digital Twin

You might be thinking, “Oli, what even is a digital twin??”

It might sound futuristic, but it’s closer than you think. In finance, it means replicating parts of someone’s knowledge, thinking and decision-making into a digital model.

Right now, there are probably skills in your team you wish you could steal. Like the way your best finance business partner prepares for a product review – their thought process, risk questions, what slides they always include.

That can now be captured and reused, not just once but hundreds of times across your team.

In 12-24 months, this will go mainstream. Finance leaders need to understand the potential now, because we’ll be redesigning teams around it.

What’s the next step?

This isn’t about turning every finance pro into a coder overnight. It’s about unlocking value, building confidence and scaling capability.

Most people won’t climb to expert level, and that’s fine… but everyone should be on the staircase.

So, ask yourself:

- Are you doing foundational things most days?

- Are you solving real problems most weeks?

- Are you ready for what’s coming next?

If you’re feeling stuck with all this, I’m helping finance leaders and teams think through this in depth. Get in touch and let me know if you’d like help in thinking through your progress.

2. The One Phrase That Unlocks Real Leadership

There’s a concept from Never Split the Difference by former FBI negotiator Chris Voss that’s pure gold for anyone looking to lead more effectively – especially in finance.

It’s the phrase: “How could we…”

At first glance, it’s simple. But used well, it’s transformational.

Here’s the problem: in finance, we often know exactly what needs to happen. We see the numbers, the risks, the inefficiencies. But when we communicate with our business partners, our instincts can betray us.

We say things like:

- “You should cut that cost”

- “We need to reduce headcount”

- “You must hit this margin target”

Even if we’re right, that kind of language often lands flat. It shuts down conversation rather than opening it up.

Now try this instead:

- “How could we deliver the same impact with fewer resources?”

- “How could we do this differently to improve margin?”

- “How could we simplify this process without losing quality?”

These questions shift the dynamic from instruction to collaboration. Suddenly, you’re not a gatekeeper – you’re a partner. The other person becomes part of the solution, not the problem.

That shift – from telling to facilitating – is a key step in moving from finance manager to finance leader. Senior leaders don’t just bring answers, they draw out better ones from others.

And in finance, where your insight often requires others to act, “How could we…” might just be the most powerful phrase you add to your toolkit this year.

This ties into a key principle from our finance business partner program: “It’s not our job to answer the question so what?, it’s our job to ask it.”

Let me know if you’d like to hear when we’re running this program next!

3. Why High Agency Could Be The Most Important Idea For Your Career

I came across a brilliant piece last week and it’s been stuck in my head ever since. It’s about a concept called high agency and I recognised it from just about all of my favourite bosses, colleagues and clients over the years – including the one who shared it with me!

In short, high agency is the mindset of not waiting for permission. It’s the ability to see obstacles not as blockers, but as puzzles to be solved.

George Mack, the original author, describes it like

When someone tells you something is impossible, do you stop, or does a second internal conversation begin on how to do it anyway?

He shares the example of Wilbur Wright (one half of the Wright brothers) who went from bedridden with no formal training, to flying the first-ever aircraft. No road map. No permission. Just relentless, resourceful, high-agency action.

So why does this matter to us in finance?

Many finance careers follow a well-trodden path.

You qualify (ACA, CIMA, CPA), you step up, you wait for the next promotion.

But what if that path isn’t the best one for you?

Or worse, what if it’s a trap?

Here’s how high agency thinking applies:

- If you’re stuck: Question the question. “How do I get promoted?” might not be as helpful as “What work would make me feel most energised?”, or “What would I do if I had 10x the confidence?”

- If you want more influence: Stop waiting for someone to hand you a seat at the table. Get closer to the business, volunteer for the project, start shaping decisions – not just reporting on them.

- If you want to lead: Leadership isn’t just about knowing the numbers, it’s about being the person your team would call if they were stuck in jail… someone who makes things happen, no matter what.

Finance needs more high agency professionals, who challenge, act and create momentum.

The good news? High agency is a skill – and you can start building it today.

It’s something I work on with many of my clients: how to take agency of what’s around you and create real impact, even when it doesn’t feel like it’s yours to own. Using high agency to make progress will be key to career success in an AI-powered world.

If this sparked something for you, the full read is well worth your time: highagency.com

(Warning: it’s an engrossing 30 min read!)

Want more insights?

Sign up to my interesting things newsletter to get tips like this and more.