My 3 interesting things for you this month…

1. 3 steps to turn finance data into business action

We spend a lot of time on our finance business partnering course helping people think about how to influence the business.

So I want to share a really high level 3 step framework on how anyone in finance can take their day to day work and drive real action and impact in their organisation.

Each of these 3 principles we go into a lot of depth individually on across the programs I work on, but I want to summarise it into 1 framework for you here.

1. So what?

The first stage is to think about the ‘so what’ from our data. Not just what it is and why, but figuring out the so what? for our organisations.

Really importantly, it’s not our job to answer the question “So what?”, but it is always our job to ask it. Which leads me to concept 2…

2. Open Questions

Open questions are the most powerful way for finance to influence the organisation.

Questions that start with ‘how’ or ‘what’ get the organisation thinking broadly about possibilities, they are more likely to generate realisations which encourage adoption, and less likely to sound like recommendations which can generate resistance.

These first 2 concepts I’ve spoken about before, but this brings me onto the third component, and hopefully the real magic…

3. Accountability

Finance has the ability to hold the organisation to account. It is one of the most fundamental parts of our role.

So we can use that very powerfully.

If our open questions enable idea generation (“What could we do to make progress?”), and then commitment to action (“What will we do between now and next month on that?”) – we can use accountability to generate real progress.

No one wants to come back and report they didn’t do their thing.

🤔 But hang on, are finance just being the police again here?! Isn’t that going to drive more resistance??

In the past yes, but something has changed.

If you have used the new Teams Copilot functionality of generating meetings notes and action items, you’ll know it’s not up to an individual notetaker to capture the key things anymore. AI will do it for us.

That means finance can turn up the next month with those notes and just ask the question: “How did we do against this?” and “What can we do differently in future to do better?”

Finance can use data, our role, and technology to drive accountability and ultimately real business action. 📈

2. Figuring out the right leadership challenges to solve

In my March newsletter, I spoke about how you can make faster career progress by solving 3 types of problems.

I got a few questions back around this topic. This is great Oli, but which problems should I try to solve?

Here’s a way to think about this.

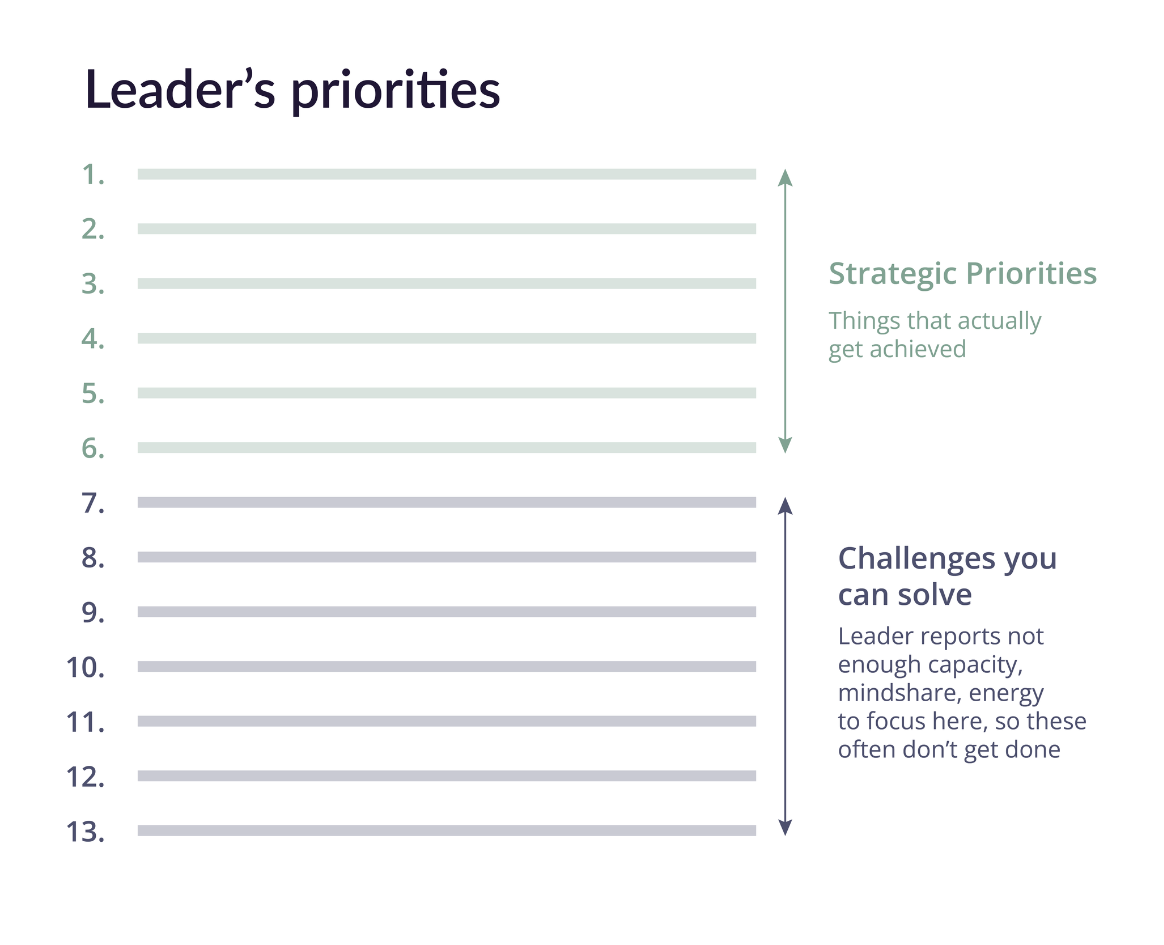

Your leader (CFO, CEO, FD, etc.) has a long list of objectives or things they’d like to solve. But they and their direct reports can’t solve them all due to capacity, mindshare, etc.

So it leaves a longtail of problems and opportunities that often go unaddressed.

This is where to look.

What kind of challenges are on the list?

What kind of challenges are on the list?

Certainly not the biggest, most important strategic priorities of the company or team. But things like: people issues, ways of working, new ideas, culture and collaboration, anything else that’s in the important box, but rarely makes the urgent box.

How do you figure out the specifics?

Start with other people – Ask about things that the leader often mentions but we never progress on? In other words, what do they care about?

Then talk to the leader – Ask what they would like to see more progress on but never really gets prioritised?

Here’s an important thing: don’t commit to outcomes! The leader won’t really expect you to.

So go away, see what you can do – and try to under-promise and over-deliver.

If it works out, you’ll hopefully start to see a step-change in your career progression.

Let me know if you’d like to talk through what some of those options could be for you.

3. How will generative AI help finance?

I have been saying this to EVERYONE I have spoken to in the last 6 months, so apologies if you’ve already heard this from me!

If you haven’t tried to use ChatGPT in a professional sense yet, now is the time to do it. Even just to play with it.

Not getting involved with this now will be the same as having decided not to get involved in the internet or in smartphones 25 and 15 years ago respectively.

It’s been a few months since I last specifically mentioned AI, so a great time for another quick round up of what’s going on:

1. ChatGPT enterprise is now out, the key difference for us in finance is that any data you enter to this version is not used to train its models – or in normal language – you aren’t putting your data onto the internet for others to access.

There are some great new features to the new ChatGPT 4, including data analysis – which you can see a 100 second video on here.

2. For anyone worried that AI will take your job, my current favourite way to think about this is: AI itself almost certainly won’t take your job, but someone using AI (more effectively than you?) might do!

So the best thing is to stay on top of what’s happening.

On that, Deloitte released a great report at the end of last month which covers a range of ways generative AI will help finance, highlighting the risks as well as the opportunities. You can check it out here.

3. Finally, if you aren’t following Adam Shilton on LinkedIn yet, you probably should do.

Adam is focussing almost exclusively on AI and Tech in finance.

He is focused on pragmatically approaching and using AI – and how finance can use it. Some really interesting stuff.

Let me know if you have any other interesting AI stories, tools or updates you’ve seen recently!

Want more insights?

Sign up to my interesting things newsletter here to get tips like this and more.