My 3 interesting things for you this month…

1. How to make toast

I spend a lot of time talking to finance leaders and teams about Finance Transformation. (You can learn more about the course that I run on this if you’re interested!).

One of the big challenges teams face is reaching a shared understanding of complex problems and the potential paths to solving them. Everyone is running around doing their own thing, focused on the same problem in different ways.

Another coach recommended this excellent 9-minute TEDTalk from Tom Wujec.

Any great TEDTalk should be engaging, change your mind/teach you about something, and give you practical next steps on applying theory. This one, “Draw How to Make Toast” hits all 3. It shows how simple visual exercises can be a great way to enhance problem-solving and collaboration.

By asking people to draw the steps of making toast, he reveals how people perceive and process information differently.

First, he asks people on their own to draw the process on a piece of paper, and then on a series of post-it notes.

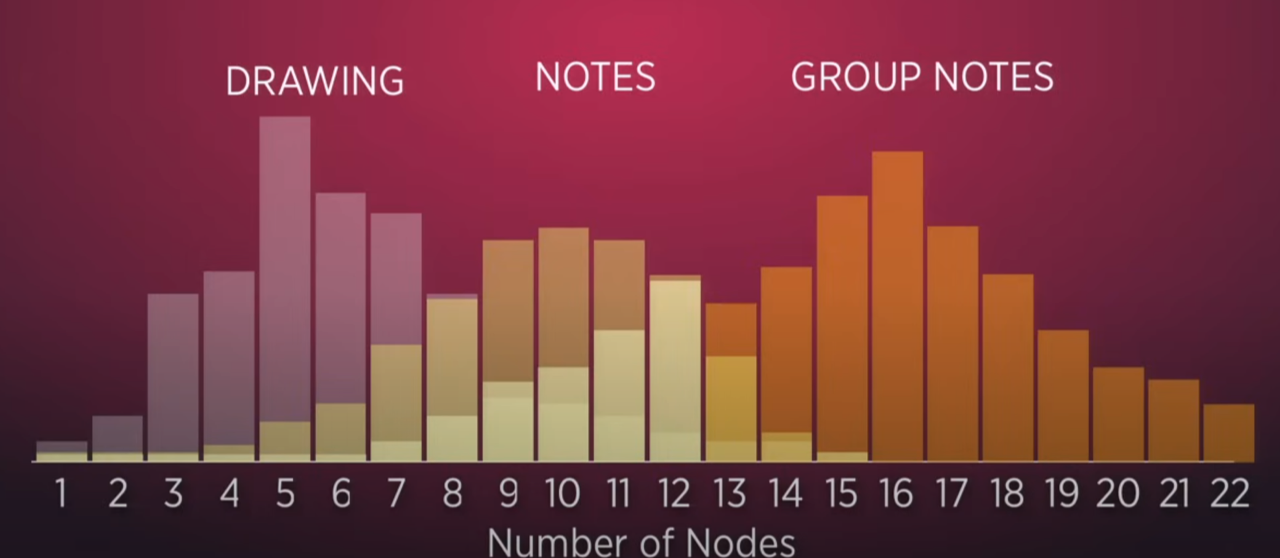

Then he asks them to do it as a group with post-it notes. Look how many more nodes/steps there are when people work together with changeable notes…

When teams collaborate on the post-it note group diagrams, they merge different viewpoints and create more detailed and comprehensive maps.

This collective approach means more open communication and insights that are often missed when you work on your own – this is highly valuable for problem solving!

Visual thinking is a powerful tool for innovation. By drawing your ideas, you can turn abstract concepts into something tangible.

This can allow your teams to better understand the problems they face and work together to solve them. By bringing visual exercises into your meetings, you can communicate better, be more creative, and build stronger team alignment.

Next time you’re facing a challenge, get your team together with some post-it notes and a whiteboard and tackle the issue step-by-step. If you can’t get your team together in person, using a Miro board is a great alternative for virtual meetings!

Let me know if you’d like some help facilitating a discussion like this!

2. Talking about the numbers vs. Talking about the business

A common challenge that finance professionals often face, especially in finance review meetings, is the distinction between talking about the numbers and talking about the business.

Dave Kellogg’s recent blog post highlights this issue: meetings getting bogged down in discussions about the definition of metrics or finance terms, losing time and leaving everyone frustrated.

This happens when people ask us so many questions about the metrics, details behind them, or even question the data accuracy.

Here’s the key takeaway: productive business discussions are driven by the numbers, but they’re not about the numbers.

It’s one thing to know that a KPI is trending down (the ‘what’), but it’s far more important to explore why they’re down and most importantly, what actions the business needs to take – the ‘so what?’.

As finance business partners, our goal should be to ensure numbers facilitate strategic decision-making, not distract from it.

This ties in perfectly with one of the core concepts from our Finance Business Partner program.

A critical role we play as finance leaders is helping the business move from endless discussions about details, definitions and data, to strategic, action-oriented insight.

How can you do this? I’ll give you 2 answers here, Kellblog’s and ours…

Kellblog says to ensure that your business partners team deeply understand the numbers before meetings, so that the focus in the meeting can remain on how to drive business performance, rather than debating the data.

We go even further. In the real world, we don’t often have time to get the business smart before the meeting. We suggest that, in meetings, you should move the discussion on from the most important points to the ‘so what?’.

You can do this by leading with powerful open questions that stimulate conversations about action – questions that start with ‘how’ and ‘what’.

If you’d like to know more about the specific techniques that we’ve empowered 14,000+ finance professionals to use – get in touch!

3. Agentic AI in finance – The future of productivity

Now for another AI update – have you come across ‘Agentic AI’ yet?

Agentic AI refers to systems capable of doing multi-step tasks without needing step-by-step human intervention.

These systems will eventually enable finance teams to spend less time on manual number-crunching, and more time on value add work.

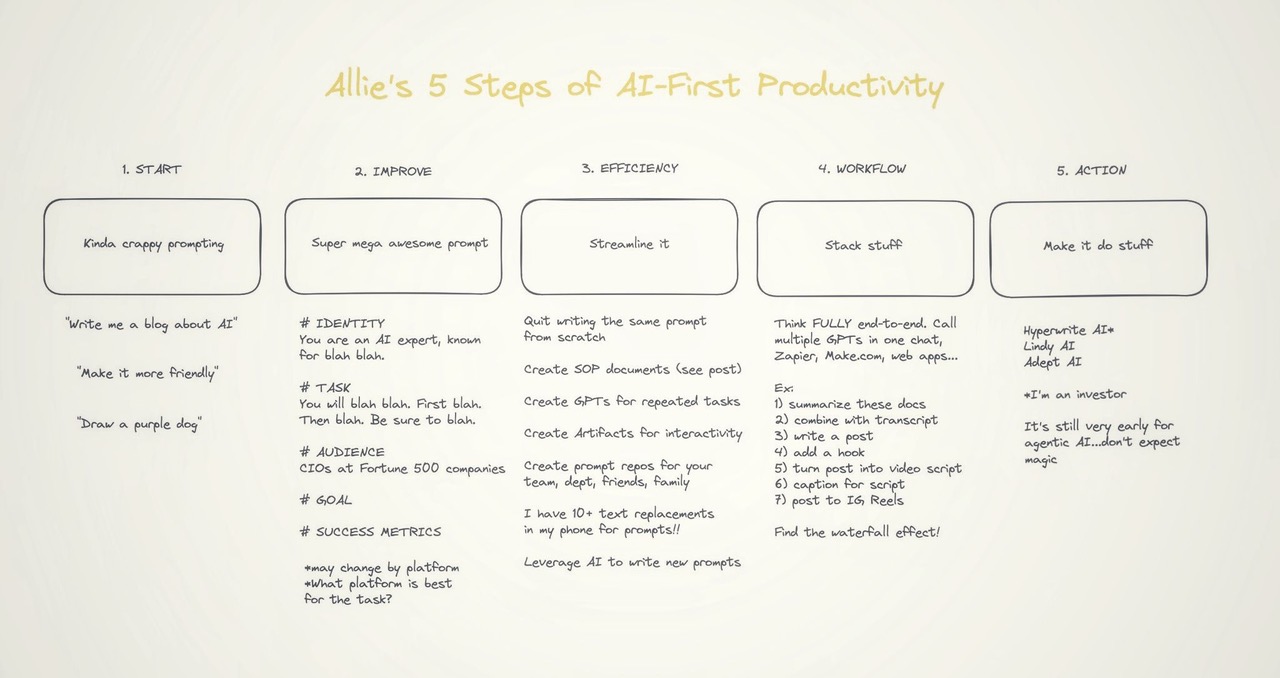

This post from Allie K Miller (talks about AI, has 1.5M followers on LinkedIn!) on “Allie’s 5 Steps of AI-First Productivity” offers a roadmap for integrating AI into daily workflows all the way through to Agentic AI, and it’s not just for tech-savvy teams.

Applying these principles can help with efficiency and deeper business insights.

Here are her 5 steps, applied to finance:

1. Start with simple prompts

An AI prompt is just a question provided to an AI tool to perform a particular task.

Googling on steroids.

Think basic automations or task requests like “how do I do an Xlookup in excel” or “write a monthly summary of this data”. This is a great first step, but only scratching the surface of what AI can do.

2. Refine AI prompts for better outcomes

To truly leverage AI, it’s important to input precise prompts.

In finance, this could mean asking AI to not just generate a report, but also provide insights into key metrics or forecast trends.

Being specific about the role you want the AI to take, the audience (for example the CFO or a business partner) and the goal (identifying variances or focusing on strategic trends) turns an ordinary task into a strategic tool.

3. Save time through AI automation

Why write the same prompt every week for your financial dashboard updates?

Streamlining with Standard Operating Procedures (SOPs) for repetitive tasks and creating reusable AI models for things like cash flow analysis can save massive amounts of time.

The real magic here is creating CustomGPTs. More on this soon!

4. Stack AI tools for end-to-end automation

Fully embracing AI means going beyond individual tasks.

By integrating tools like Lindy AI into your finance stack (note this is relatively new and I haven’t personally tried it yet!), you can automate end-to-end processes.

For example, summarising the quarterly earnings, combining them with an executive summary, and generating content – all without manual intervention.

5. Action and innovation with agentic AI

While it’s still early days for agentic AI, the potential is vast.

Tools are already emerging that can act independently, handling tasks like automating accounts payable, generating financial insights, and even responding to enquiries – think human involvement rather than human oversight.

It will be a while before these are up and running and stable, but keep an eye on how these evolve.

The future of finance isn’t just about keeping on top of the numbers; it’s about leveraging AI to redefine what’s possible.

As agentic AI evolves, finance professionals will spend less time buried in data and more time focusing on strategy and innovation.

As always, I will keep you up to date on what’s new.

Want more insights?

Sign up to my interesting things newsletter here to get tips like this and more.