My 3 interesting things for you this month…

1. Testing for intelligence: The laws of stupidity and job hunting

This is a really insightful post from Rahim Hirji on LinkedIn that highlights an often-overlooked aspect of human interaction: the laws of stupidity.

Originally discussed by Italian economist Carlo Cipolla, the concept revolves around the idea that people can unintentionally cause harm to others while also harming themselves—this is what Cipolla defines as “stupidity.”

Originally discussed by Italian economist Carlo Cipolla, the concept revolves around the idea that people can unintentionally cause harm to others while also harming themselves—this is what Cipolla defines as “stupidity.”

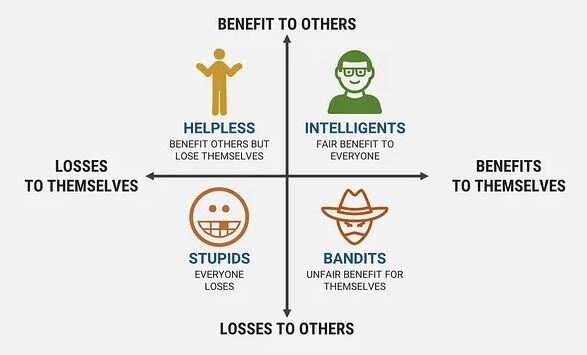

Cipolla categorised people into four groups based on how their actions affect themselves and others:

- Stupid: They cause losses to others while deriving no benefit themselves.

- Helpless: These people suffer losses themselves but benefit others. They are often taken advantage of.

- Bandits: They benefit themselves at the expense of others.

- Intelligent: Their actions benefit both themselves and others, leading to a net gain for society.

In the context of job hunting, many candidates focus heavily on showcasing their ‘intelligence’ to prove their worth. However, they often overlook an important aspect: evaluating the potential “stupidity” within the organisation they are applying to.

So how do you apply this idea to your job search? Here are a few actionable steps:

- Assess the organisation’s decision-making: During interviews, pay attention to how hiring managers discuss their decision-making processes. Are they transparent about challenges and failures, or do they gloss over them? Look for red flags that might indicate a lack of strategic thinking.

- Ask about team dynamics: Ask about team culture and collaboration. Are there clear examples of teamwork and mutual support, or is there a blame culture when things go wrong? Understanding this can help you gauge whether the team environment is productive or potentially “stupid.”

- Evaluate the interviewers: Pay attention to the questions you’re asked. Are they thoughtful and relevant, or do they seem to lack depth and understanding of the role? The quality of the questions can be a strong indicator of the hiring manager’s competency.

The goal is not just to land a job but to find a place where you can get to where you want to be. Assess the company as much as they are assessing you!

Let me know if you’d like some help applying some of these principles.

2. Specialists vs. Generalists: Balancing your team’s perspectives

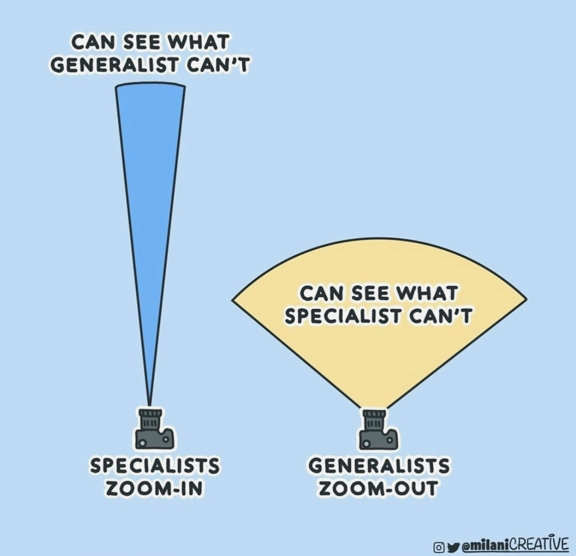

I came across an interesting graphic shared by organisational psychologist Adam Grant, highlighting a critical dynamic in team composition: the balance between specialists and generalists.

It’s from David Epstein’s book, Range: Why Generalists Triumph in a Specialized World, which explores the unique advantages both specialists and generalists bring to the table.

This graphic captures this idea really well: specialists are like a magnifying glass, zooming in on specific problems, while generalists offer a wide lens, seeing connections and possibilities that specialists might miss.

When it comes to teams, understanding and leveraging the strengths of both can lead to more innovative outcomes.

Here’s how this concept can be applied to your team and projects:

1. Leverage diverse perspectives

When building teams, think about the balance between these two types of thinkers.

A project team with both specialists and generalists can approach problems more holistically, combining deep technical knowledge with creative problem-solving.

2. Avoid overvaluing specialisation

A financial analyst specialising in forecasting might be awesome at developing detailed models, but a finance business partner generalist with a background in both finance and partnering marketing might better understand market trends and consumer behaviour, providing insights that enhance forecasting accuracy.

Try to optimise for both!

3. Encourage cross-functional learning

Encourage team members to learn outside their immediate area of expertise.

Try implementing cross-functional projects or job rotations to foster this type of learning within your team.

This empowers employees to develop a more rounded skill set, especially useful in leadership roles where being strategy first matters.

3. Six principles to optimise your career and results

I recently came across this insightful article on Kellblog on 6 principles that can help achieve better results and advance your career. These principles are particularly relevant to us in finance, where clear communication, analytical acumen, and effective management are crucial.

Here are my 3 favourite principles and some actionable tips on how you can apply them:

1. Know your in-memory analytics

Being in finance often means being the go-to person for numbers and analytics. It’s essential to know the key metrics relevant to your role as if they were second nature.

This readiness is often used by executives as a test of your competence.

Actionable Tip: Identify the critical KPIs and the key ‘How does this business work?’ formula (mentioned in a previous newsletter) for your role—be it revenue growth, cash flow, or ROI—and commit them to memory. Regularly update yourself with the latest figures so you’re always prepared to discuss them confidently in meetings.

2. Understand the three fundamental layers of management

Each layer of management – manager, director, leader (CFO/VP/Partner) – requires a distinct way of thinking.

Understanding these differences and anticipating the expectations of the next level can help you progress your career more effectively.

- Managers are paid to drive results with some support. They have experience in the function, can take responsibility, but are still learning the job and will have questions and need support. They can execute the tactical plan for a project but typically can’t make it.

- Directors are paid to drive results with little or no supervision (“set and forget”). Directors know how to get the job done. They can make a project’s tactical plan in their sleep. They can work across the organisation to make things happen.

- Leaders are paid to make the plan. If you’re the CFO, your job is to understand the company’s business situation, facilitate a strategy to address it, build consensus to get approval of it, and then empower the organisation to execute it.

Actionable Tip: If you’re a manager, start thinking like a director. Focus on strategic planning and cross-departmental collaboration. Understand that as you move up, the scope of your responsibilities will broaden and the impact of your decisions will become more significant.

3. Be a simplifier

The ability to simplify complex financial concepts is invaluable. Simplification enhances understanding and decision-making. Everyone loves a simplifier.

Actionable Tip: When preparing financial presentations or reports, stick to the 3 most important things. Focus on the ‘so what?’, and provide context for data to ensure that stakeholders understand the action required.

Check out the other 3 things in the full article on Kellblog and let me know what you think!

Want more insights?

Sign up to my interesting things newsletter here to get tips like this and more.