My 3 interesting things for you this month…

1. Using AI to solve your “how” problems

We already know AI is non-negotiable in finance. But most teams don’t know where it can make the biggest impact today.

Most leaders assume the goal of AI is to delegate their work to machines – to get AI to forecast, analyse, or write reports. I call these ‘what’ problems. In the long run, yes this is the goal, but currently there are two key reasons ‘what’ problems are not really viable for AI to solve in 2025.

First, the risk is too high for most teams in trying to load their data into the best AI models. Secondly, the technology is not really ready. Either our AI models that support secure data aren’t good enough, or the problem is too hard right now.

So, the real value today isn’t in ‘what’ problems – delegating our to work. It’s in improving how people work.

What problems vs. How problems

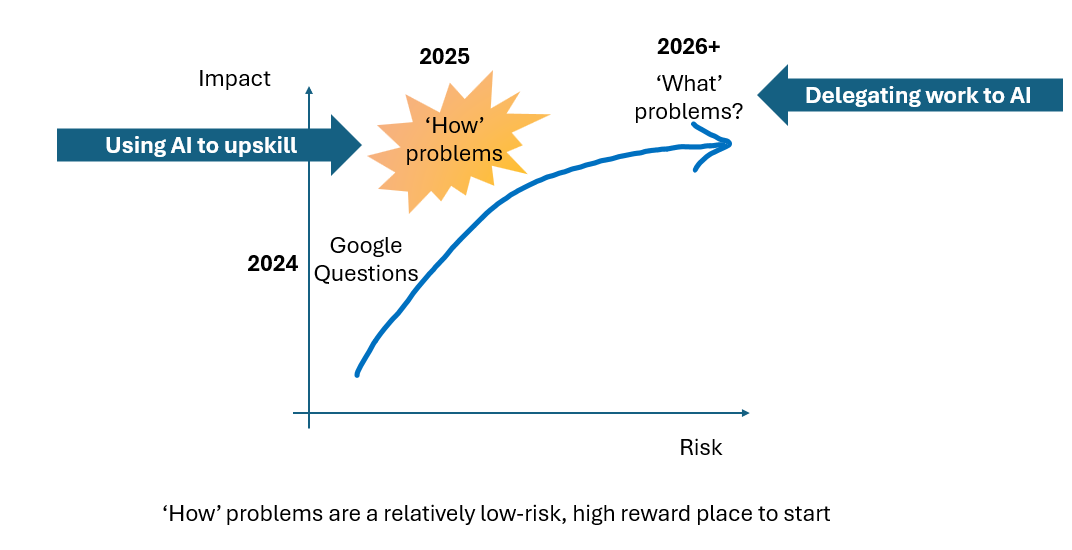

In my Making AI a Daily Habit workshops with finance teams, I share this graphic to think through this. The x-axis is how risky an AI use case is, the y-axis is how impactful it is. Making progress up and to the right is based on how useful the outcome of the AI work is to our daily lives.

The challenge is the basic use case of generative AI such as ChatGPT and Claude I replacing Google. It’s really interesting, but often not that useful in our work.

At the other end, delegating work is going to be incredible in the future, but today 95%+ of finance teams can’t reliably get AI to give significantly more useful results when they attempt to get AI to solve ‘what’ problems

So, the sweet spot right now? Solving “how” problems, not “what” problems.

“What” problems ask AI to do the job: build the model, write the report, design the plan. These are high-risk and still need heavy human oversight.

“How” problems use AI to make the human better at the work: make your smarter at doing your day job, improve how you do your processes, how you make the most of the technology you already pay for, brainstorming a path through complex problems.

These low-risk, high-return areas are where finance teams can quickly shift from AI daily use of 15% of the team, to 50–70%+. This use case will enable AI to rapidly become much more useful in their day to day work.

Instead of asking “Can AI do this for me?”, ask “How can AI help me do this better?”

So what can we do to solve ‘how problems’?

Try this: Pick an annoying process or something that doesn’t work well in your team, like errors that keep cropping up in your month-end close.

- Start an AI prompt with “Act as a transformation consultant advising a finance manager in [your industry or context].”

- Then, explain the problem and the ideal outcome you would like. Give specifics of the tools you use and constraints.

- Next, ask for help improving whatever the work is.

- Finish the prompt with “What other questions would you ask, in order to improve the answer.”

This will enable you to make rapid progress on “how” problems worth solving.

But won’t AI “agents” do this for us??

You’ve probably heard software vendors talk about “AI agents” that can handle complex work on their own. The truth is, almost no one has them working usefully at scale… yet.

Tech companies know that fully autonomous AI systems will eventually transform businesses and work. But building them safely is still extremely difficult. Each step adds risk, every “decision” compounds errors and the hardest part is building in human judgement.

That’s why most companies today are using one of two simpler approaches:

- AI automations: simple “if this, then that” logic powered by large language models. Great for repeatable, well-defined tasks like reading an invoice or assigning account codes or cost centres.

- Agentic workflows: systems with limited autonomy inside guardrails. They can analyse, route or draft outputs, but only within clear boundaries. These are where finance teams are seeing the most success today. They’re practical, safe and quick to implement – but still relatively narrow in their use cases.

Watch this space – as we have more news on high-functioning, scalable agents in finance, I’ll let you know right here!

2. Turn AI curiosity into capability

Sometimes the hardest part of using AI is knowing what to ask it. One of the most common Q&A questions I get is: ‘What are some prompts for common use cases?’

Finally, a handy resource for this! Try OpenAI’s new free prompting resource: ChatGPT for Finance. It’s a practical toolkit that turns AI curiosity into capability, with ready-made prompt packs for real finance tasks.

The course breaks prompts into five key areas, relevant to finance.

Where this makes the biggest impact

While prompts for forecasting and planning are helpful, they often depend on internal data you can’t share. The biggest impact comes from process and communication prompts, where you can apply ideas instantly with no risk. (Recognise these from ‘How problems above?!’)

Here are two examples straight from the resource:

- Identify accounting process gaps: Review our current accounting close checklist and suggest improvements. Use this documentation: [insert SOP or task list]. Output should highlight bottlenecks and recommend process updates.

- Procurement strategy cost levers: I’m leading a finance initiative to cut procurement costs. Research strategies used by Fortune 500 companies to reduce procurement spend without harming supplier relationships. Present 3–5 tactics with cost impact examples and cited sources.

These kinds of prompts help teams rethink how they work, not just what they produce. They generate ideas, expose inefficiencies and start conversations that lead to better systems.

There’s even a section on visual storytelling with prompts like: “Create an image of a revenue growth funnel with labelled stages: Acquisition → Activation → Revenue → Retention → Expansion. Use a clean, modern style suitable for an executive presentation.”

The visuals aren’t always perfect, but they’re great for prototyping presentation ideas fast (remember our visual frameworks interesting thing from last month?).

How to use this with your team

If you want to help your team get hands-on with AI, try a one-hour session together.

Pick one category from the OpenAI pack, like communication and reporting. Choose a few prompts and run them live.

Compare results, discuss what worked, and adapt the prompts together. Capture your learnings into a shared “prompt library” for future use.

The real value comes from that discussion, when people learn from each other and build confidence to experiment. It’s how you create team-level capability, not just individual skill.

Try experimenting in Excel

Want to take it a step further? This is the one we’ve all been waiting for, but it’s SUPER early days right now.

Claude, another leading AI model, recently built a working Excel model. It’s not perfect yet, but it’s a big step toward AI moving from writing about data to actually working with it. Claude is a bit ahead of ChatGPT on this open – another reason why it’s good to keep up with which models are best at different things!

The challenge with excel and AI is our bar for ‘done’. It doesn’t matter if the language in your email is only 95% perfect, if it gets the right message over. But in a spreadsheet, anything other than 100% accuracy in the model is a major problem!

We’re probably six to twelve months away from AI being ready to edit and improve spreadsheets directly, but you can start playing with this today creating a new model from scratch. Try asking Claude to build a cashflow forecast template, build a 3-way financial statement or design a dashboard layout.

3. How to avoid shadow AI users

MIT found that 95% of corporate AI initiatives show no measurable P&L impact. At the same time conversely, up to 80% of employees are already using AI unofficially, often reporting 20–40% productivity gains.

So why are we seeing such a gap between corporate sponsored AI progress and individual employee AI progress?

The “shadow AI” revolution is boosting individual performance, but quietly weakening organisations.

What shadow AI is – and why it’s a problem

Shadow AI happens when employees use tools like ChatGPT without company approval or guidance. It’s often well-intentioned – people just trying to be more effective – but it creates hidden risks.

Without shared learning or governance, quality becomes inconsistent and collaboration erodes. Teams lose the communal problem-solving that builds capability and trust.

It’s also changing the job market. Younger professionals comfortable with AI are moving faster, while those waiting for formal training risk falling behind.

The four AI economies of the future

Shadow AI is creating a new structure for how work gets done. Most roles will eventually fall into one of four categories:

Automated – Machines do the work. Great for efficiency, risky for careers.

Assisted – Humans check AI outputs they don’t fully control. Stable for now, but limited.

Orchestrated – Humans design and guide AI systems – AI managers.

Human Premium – Humans offer what AI can’t: judgement, trust and influence. The growth zone – Finance Business Partnering is the future.

Right now, many people assume they’re heading for these last two – Orchestrated or Human Premium. But data suggests a lot of roles risk becoming stuck in Assisted, monitoring machines instead of mastering them.

I believe that in 10 years’ time, 80% of finance teams will be doing one of 2 things – Managing AI or Business Partnering. So how do we close this gap?

What leaders can do

If you’re leading a finance function, you can turn shadow AI into shared capability by bringing it into the open – ‘into the light’ you could say :).

Run an AI amnesty: Invite your team to share how they already use AI – no judgement.

Set guardrails and use cases: Publish simple guidelines on what’s in-bounds and what’s not. Share when you really WANT the team to use AI.

Capture wins: Document useful prompts and turn them into shared playbooks. A shared OneNote is great for this.

Recognise two roles: The Orchestrators who build workflows (AI Managers) and the Human Premium specialists (Business Partners) who excel at storytelling and influence.

Measure outcomes: Track and recognise time saved and quality improvements, not just usage. When AI learning is shared, culture strengthens. When it’s hidden, it fragments.

Build to learn what to buy

Finally, when it comes to AI, the smartest finance leaders aren’t waiting for the perfect tool – they’re experimenting to understand what’s worth investing in.

As Siqi Chen, CEO of Runway, puts it: “Build to learn what to buy.”

In a market full of AI hype, small experiments build intuition. When you play around with AI, whether it’s prompting ChatGPT to automate a report or testing a new workflow in Power BI, you learn what’s real, what’s useful and what’s not ready yet.

That insight makes you a sharper buyer. You’ll know when a vendor’s promise is solid, when it’s smoke and mirrors and when you’re better off building something simple in-house.

And over time, as AI tools become commoditised, your edge won’t come from the tech itself. It’ll come from how you train, evaluate and apply it – the human skills that define great finance leadership.

Let me know how you’re getting on with your AI journey – I’d love to share some more success stories!

Want more insights?

Sign up to my interesting things newsletter to get tips like this and more.