My three interesting things for you this month…

1. Influence = Competence + Likeability

Many of the finance leaders I work with have the same question: “How do I increase my influence?”

Influence is how we make a real difference. It’s what moves finance teams from number-crunchers to business partners and decision-makers.

But it’s not something that magically appears as we move up the ladder. Like any other skill, influence can be practiced, built and refined over time. A simple way to think about it is:

Competence (your skills, expertise and insight) + Likeability (your people skills, empathy and connections) = Influence

Real influence lives in the balance. Too much of one without the other can create blind spots and affect how others’ see you.

- Competence without likeability makes you the expert in the corner – trusted for the facts, but not seen as someone who can rally others or shape the next steps.

- Likeability without competence makes you the friendly face people enjoy having around, but not the voice they turn to when stakes are high.

Here are some practical ways to build that balance.

1. Deliver insights, not just data

In senior conversations, you often only have seconds to show you’ve done the work.

Lead with a sharp insight or a clear recommendation, not a data dump.

Frame your point in a way that resonates with your audience – speaking the language of commercial, operations or strategy leaders, not just finance. Try following a “What, Why, So What?” structure to connect numbers to business impact.

2. Show curiosity, not just answers

People want to feel heard, not lectured. Ask one or two thoughtful questions before sharing your perspective – it shows you value their input and builds trust.

Lead with curiosity in conversations: explore where others are coming from, what pressures they face and what success looks like for them. That context makes your recommendations a lot more influential.

3. Adapt your style to the moment

Influence often comes down to judgment – knowing when to lean into relationship-building and when to lean into technical credibility.

In a boardroom, you might need to lead with sharp financial insights. In a cross-functional workshop, it might be better to focus on connection and collaboration. The best leaders flex their approach to fit the room.

4. Invest in relationships before you need them

Influence isn’t built in the meeting itself. It’s built in the conversations before and after – the quick check-ins, the moments where you show genuine interest in colleagues’ priorities. When trust is already there, your competence lands with more impact.

The finance leaders I coach who master this balance are the ones shaping strategy, not just commenting on it. They’ve built reputations as trusted advisors: smart enough to be credible, human enough to be heard.

So this month, ask yourself: in your last big meeting, which side did you lean too heavily on – competence or likability? And what small shift could you make to bring more balance next time?

2. How visual frameworks can improve strategic conversations

Most finance leaders want their teams to think more strategically. The challenge is finding practical ways to build that skill.

Often, leaders try to encourage strategic thinking by giving teams more numbers to look at. The effect is the opposite – conversations get too technical, people get stuck in details and the bigger picture disappears.

The trick isn’t to throw more numbers at the team. It’s to create a way for everyone to step back and see the bigger picture.

Visuals make strategy accessible. Add a simple framework to a discussion and you make things easier to understand, you keep attention on the big choices and you help non-finance colleagues see trade-offs more clearly.

Why visuals work in finance conversations

- Shared language: A sketch levels the field between commercial, ops and finance. You spend less time debating definitions and more time on decisions.

- Choice over detail: Pictures force prioritisation. You can’t include everything – so the team focuses on what matters most.

- Memory and momentum: Leaders remember an image long after a spreadsheet is forgotten, which makes follow-up easier.

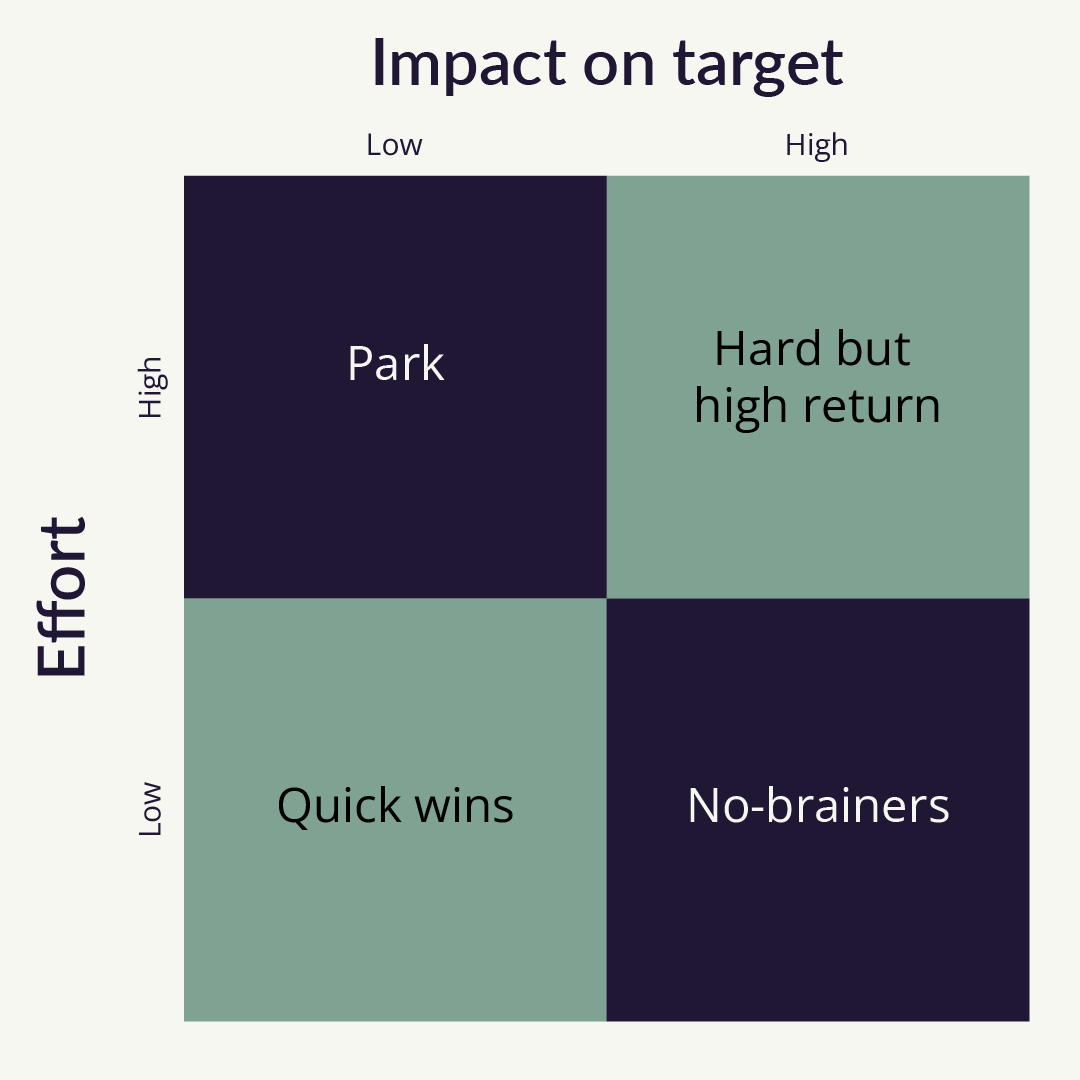

Example: Using a matrix to prioritise initiatives

Imagine your team needs to decide between competing initiatives. Rather than reviewing endless slides, draw a simple 2×2 matrix:

Tip: Draw it live. A rough whiteboard beats a perfect slide because people can see their input appear.

How to run it:

- Agree the target first: profit, cash, risk, etc.

- List current or proposed initiatives.

- Place them on the graphic, then circle the top three.

- Capture owners and next step on the board.

Keep it grounded with a simple rule of thumb for “impact” and “effort” – for example, gross margin per quarter vs. months to implement. That way, the debate stays practical, not theoretical.

The mindset shift

This isn’t about making finance look “simple”. It’s about making strategy clearer.

Visualising ideas helps people step back from detail, see connections, and engage in the trade-offs that really define strategy. It gives everyone a voice in the discussion, not just those most comfortable with numbers.

And there’s no one perfect framework. Sometimes the 2×2 matrix is enough. In other situations, a funnel, timeline or roadmap sketch works better. What matters is keeping the conversation focused and accessible.

At Microsoft, we always had a whiteboard nearby. But honestly, a piece of paper is just as effective. Draw, test, iterate. The rougher it looks, the more people feel able to add their own ideas.

If you try this out, let me know how it goes!

3. ChatGPT-5 comes to Microsoft Copilot

The big news this summer is that Microsoft has now introduced ChatGPT-5 into its Copilot ecosystem across Microsoft365, Teams, Excel and more.

Until now, Copilot has been a useful but sometimes clunky add-on – helpful in some situations, but not consistent enough to rely on. With GPT-5 built in, it’s taken a noticeable step forward. It’s sharper at reasoning, better at handling longer conversations and more intuitive in how it understands context.

When ‘Try ChatGPT-5’ is selected in the Edge Broswer window, Copilot now feels less like a generic AI assistant and finally more like a tool that understands the flow of your work – especially helpful as it’s embedded directly into the apps you already use every day.

But it’s not flawless yet.

- Accuracy still varies: Complex or highly technical prompts sometimes get over-simplified. You’ll still need to sense-check outputs.

- Context can slip: In longer conversations, Copilot sometimes “forgets” earlier details, meaning you need to re-prompt.

- Integration isn’t perfect: Depending on your licence and setup, responses can lag or behave inconsistently between apps.

What this means for finance leaders

The real shift isn’t just that GPT-5 is smarter. It’s now built into the Microsoft tools you and your teams already spend hours in every day – so experimentation has never been easier.

My advice? Don’t wait until Copilot is perfect – start using it now. Pick one workflow where you know your team spends too much time, and see how GPT-5 within CoPilot handles it. Encourage your team to share where it worked well and where it fell short.

Those conversations are where the real value comes. They spark new ways to adapt workflows, build confidence in using AI, they help you establish rules of thumb for when and how Copilot adds the most value.

Want more insights?

Sign up to my interesting things newsletter to get tips like this and more.